Natural Stone Research & Promotion Program – Frequently Asked Questions (FAQ)

What is a Check-off?

In the U.S. it is common for an industry to join together and create a "check-off" program. Currently there are 21 federal check-off programs with numerous others authorized at a state level. You likely know of several such check-off programs: National Dairy Board (Got Milk? ®), Cattlemen's Beef Board (Beef. It's What's for Dinner®), Cotton Board (The Fabric of Our Lives®), plus several more. Combined, these boards/councils raise almost $900 million dollars to promote their respective products to consumers every year or address critical research priorities as needed. Congressional approval is required for an industry to establish a “Research and Promotional Board.”

How would this program benefit the Natural Stone Industry?

- Provide industry funds to promote natural stone and increase demand through advertising, consumer education, and market research

- Strengthens natural stone’s position in the marketplace by maintaining and expanding markets

- Prevent “free riders”—everyone contributes

- Build consistent product presence

- Fund industry product and development research

- Industry-wide mechanism to communicate the superiority of natural stone and other key marketing messages.

- Increase long term economic growth of all sectors of the industry

- Gives the natural stone industry the resources to grow its market share

What assessment is being proposed?

- If the natural stone industry is successful in getting approval to establish a “Natural Stone Research and Promotional Board” (check-off) the actual assessment will be determined by a new industry board (separate from existing trade associations) to determine the final assessment.

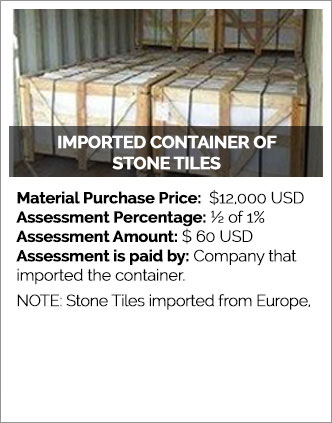

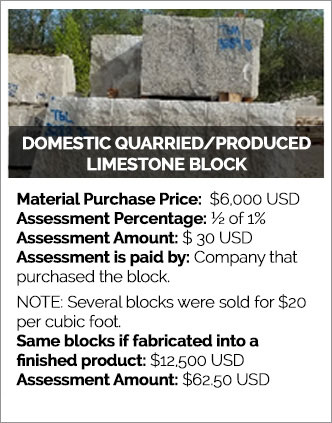

- Yet, the assessment being advocated is: ½ of 1% (.005)

- While the assessment amount is small, it will generate significant funding to assist the industry. The return-on-investment shown by other industries has been impactful.

How much money would be generated to benefit the industry?

With full support of the natural stone industry, the annual assessment would generate slightly over $16 million dollars.

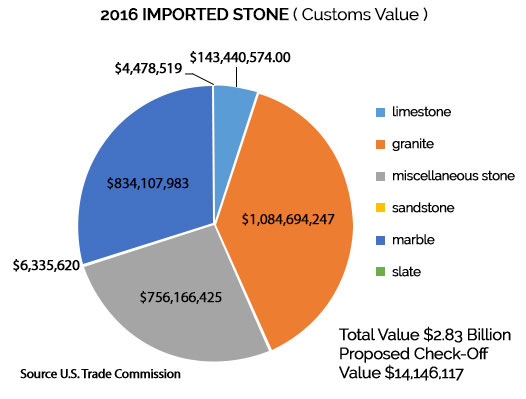

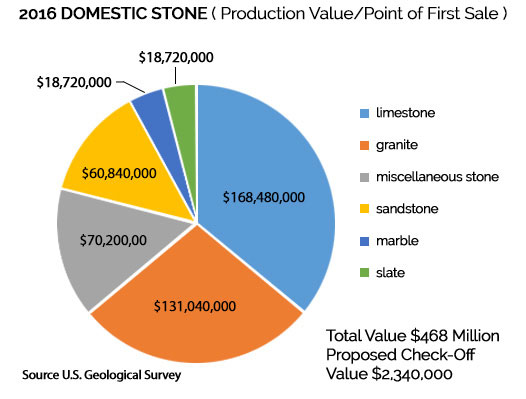

How much of the revenue will come from imported vs. domestic stone?

Using 2016 data as a baseline example, approximately 85.8% would come from a .005% assessment on imported stone and 14.2% would come from domestically produced stone. See additional details below.

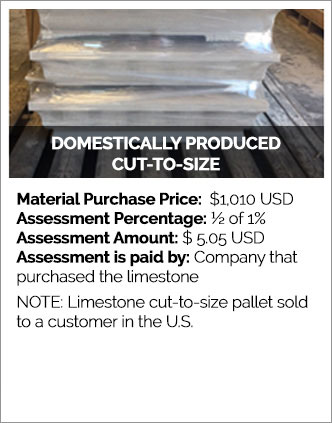

Assessment Example – Imported & Domestic Materials

In general terms, how and where would the assessment be applied for imported materials?

The assessment would occur at port-of-entry. U.S. customs would collect the money and transfer it to the Natural Stone Research & Promotional Board.

In general terms, how and where would the assessment be applied for domestically produced materials?

The assessment would occur at the first bill of sale (likely the quarry and/or producer). The assessment would appear on the bill of sale as the “Research & Promotion Assessment” and would appear on the invoice much like a “freight surplus” would be referenced. The payment would likely be made quarterly to the Research & Promotional Board.

Other commonly asked questions….

Would stone aggregate be included in this program?

No. It is not the intent to include natural stone aggregate.

Who is funding the lobbying effort to get a check-off authorized?

Several stone companies along with stone associations have contributed to cover the cost of the lobbying effort.

How long will the authorization process take?

The authorization process could take two years. An additional year will be needed to assemble the Natural Stone Research & Promotional Board and establish the official program. It is also during that timeframe that the industry will vote on whether or not to implement the program.

Who will be appointed to serve on the Natural Stone Research & Promotional Board (NSRPB)?

The board will be primarily composed of individuals who represent companies (quarry/producers, importers, and distributors) that are paying the assessment. It is important to note that this board will be independent of existing stone associations, although we anticipate a very close working relationship between them.

Will the industry be given the opportunity to vote if they want this program implemented?

Yes. Once the NSRPB has fully developed the program guidelines and implementation plan, an industry vote will be taken to confirm support. Eligible voters will include companies who are paying the assessment.

Since the Natural Stone Institute and several companies are funding the lobby effort to obtain legislative authorization, will they be receiving the revenue anticipated from the program?

Again, a separate board (NSRPB) will be managing the revenue/program. It is anticipated that the NSRPB will create an application process for individual associations, as well as stone companies to petition funding for specific projects.

Can you provide some examples of how the funding could be used for research to support natural stone?

The example many remember is the one many businesses barely survived – the radon scare the industry experienced in 2008. The issue of granite containing radon had surfaced repeatedly over the years, often fueled by manufacturers of radon detection devices and producers of synthetic stone countertops. Their scare tactics had people believing that if you use natural stone (specifically granite) that you could get cancer.

At that time the industry (led by the Natural Stone Institute) and several natural stone producing companies and other trade associations, responded by engaging independent researchers to determine if any potential health hazard exists. Studies have consistently verified that granite countertops are safe.

In 2008, over $1.2 million was spent on the costs of research and to fight the false news perpetuated by alarmists. Had the Check-off program been in place then, monies would have been in place to battle the questionable science peddled by people who stood to gain financially from a public panic because they either tested for radon or sold competing products.

Can you provide some examples of how the industry might utilize the funding to promote natural stone?

One obvious use will be for the NSRPB to utilize the work of the Natural Stone Institute to expand the current natural stone promotional campaign (www.usenaturalstone.org). Through this program all types of natural stone use (interior and exterior) is being promoted through social media, bloggers, online CE classes for architects, etc. Although the NSRPB will be utilizing a much larger budget and thus able to expand this work far beyond what stone associations can do on their own.

Yet, individual stone associations can also seek funding from the NSRPB to expand promotional activities. For example:

- The NSC could expand it’s outreach at GreenBuild or the AIA show. It could also expand the promotion of sustainability. (NSC 373).

- The EGA could use funding to promote using natural stone (vs. competing products) to memorialize the memory of a loved one.

- The NY and PA Bluestone Association(s) could create a series of articles about the use of bluestone for interior and exterior surfaces with architects.

- Etc.

Will the promotion focus on both interior and exterior stone use?

Yes – since natural stone can be used in both interior and exteriors, all types of stone use will be featured and highlighted. For example, if you look at the articles published on usenaturalstone.com you will find all types of stone use featured – the same is anticipated for the expanded program utilized by the NSRPB.

Since most of the money generated will come from imported goods, does that mean that the promotion of natural stone will favor imported products?

No. The promotion will highlight the benefits of natural stone use and not focus on any one place of origin. The key is to increase the awareness and use of natural stone and ultimately the entire natural stone industry will benefit (e.g. the natural stone pie becomes larger).

Provide some examples of research projects the natural stone industry could undertake if this is approved?

Industry needs may change, however, some early thoughts include: 1) more life cycle analysis between natural stone and competing products; 2) align natural stone with emerging BIM systems; 3) develop more case studies about natural stone. Obviously, if the industry had this program in 2008 the “radon in granite” scientific testing could have been funded through this program. The needs of the industry will need to be assessed at that time, but the luxury will be that funding will be available to address important industry research projects.

Is this a government tax?

Technically, it is an assessment approved by the industry and not a government tax. Revenue from taxes are spent by government for purposes determined by the government. The assessment will be determined by the stone industry and the assessment revenue will be managed by the natural stone industry. In short, industry is in control.

Can these funds be used to lobby Congress for key industry concerns (regulations, tax code changes, etc)?

Revenue from Check-off programs cannot be used to fund lobbying efforts.

What is the timeline for implementation?

The timeline is as follows:

- 2018 – Congress authorized the USDA to study our request for a check-off program.

- 2019 – USDA to issue a report/findings which was supported the creation of a natural stone check-off program.

- 2021 – Congress to consider bill authorizing a check-off.

- TBD – Create the NSRPB, establish the formal program, and seek industry approval. Start collecting monies once approved.

- TBD – first full year of NSRPB operation.